Central Banks

What is a Central Bank

A central bank, also known as a reserve bank or monetary authority, is a financial institution that manages the monetary policy, of a country or group of countries, toward a goal of economic and financial stability. By controlling money supply and the availability of credit, a central bank can direct an economy in a chosen direction.

Functions of a Central Bank

In addition to establishing and regulating monetary policy, central banks will generally have functions and mandates that include reserve management, banking supervision, issuance of national currency, maintenance of the value in their currency, ensuring financial system stability, controlling credit supply, serving as a lender of last resort to other banks and acting as their government’s banker.

List of Central Banks by Region

Early History of Central Banks

The concept of a central banking system goes back to the seventeenth century with the founding of the first institution to be recognized as a central bank, which was the Swedish Riksbank. It was established in 1668 as a joint stock company. The Swedish Riksbank was chartered to lend the government funds and to act as a clearing house for commerce.

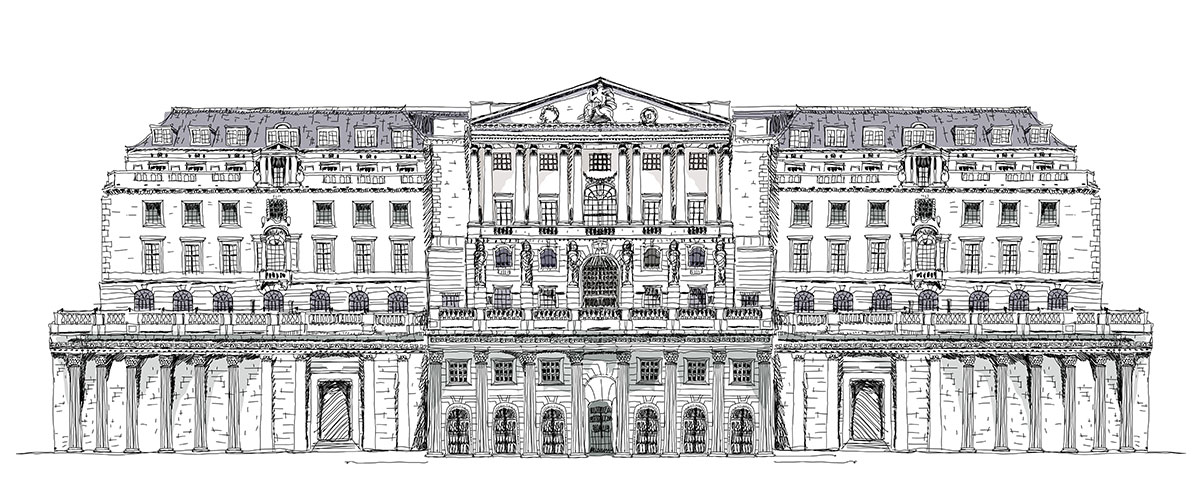

In 1694, the most famous central bank of the era, the Bank of England, was founded. It was also established as a joint stock company to purchase government debt. Other central banks were set up in Europe for similar purposes but some were also established to deal with monetary disarray.

The Banque de France was established by Napoleon in 1800 to stabilize the currency after the hyperinflation of paper money during the French Revolution. The bank was also used to aid in government finance. Early central banks issued private notes, which served as currency and they often had a monopoly over such note issues.

While these early central banks helped to fund the government debt, they were also private entities that engaged in banking activities. Since they held the deposits of other banks, they came to serve as banks for bankers, facilitating transactions between banks or providing other banking services.

Central banks became the repository for most banks in the banking system because of their large reserves and extensive networks of correspondent banks. This allowed them to become the lender of last resort in the face of a financial crisis, which meant they became willing to provide emergency cash to their correspondents in times of financial distress.

Central Bank of the United States

The United States had two central banks in the early nineteenth century. The Bank of the United States (1791–1811) and a second Bank of the United States (1816–1836). Both of which were set up on the model of the Bank of England, but unlike the British, Americans had a deep distrust of any concentration of financial power or of a central banking authority, so in each case, the charters were not renewed.

The 80-year period that followed was characterized by considerable financial instability. Between 1836 and the beginning of the Civil War, a period known as the Free-Banking Era, states literally allowed free entry into banking with minimal regulation. Throughout this period, banks failed frequently and several banking panics occurred.

The payments system was also inefficient, with thousands of dissimilar-looking state bank notes and counterfeits in circulation. In response, the government created the national banking system during the Civil War. While the system improved the efficiency of the payments system by providing a uniform currency based on national bank notes, it still provided no lender of last resort, and the era was filled with severe banking panics in 1873, 1884, 1893 and 1907.

The crisis of 1907 was the breaking point for the United States, which led the United States Congress, in 1913, to establish the Federal Reserve System with 12 regional Federal Reserve Banks. They were given the mandate of providing a uniform and elastic currency, one which would accommodate for the seasonal, cyclical and secular movements in the economy, and to serve as a lender of last resort.

The Shift in Central Banking

The US Federal Reserve belongs to a later wave of central banks, which emerged at the turn of the twentieth century. These banks were created primarily to consolidate the various financial instruments that people were using for currency and to provide financial stability. Many were also created to manage the gold standard, which most countries were using.

The gold standard, which was popular until 1914, was a system where each country defined its currency in terms of a fixed weight of gold. Central banks held large gold reserves to ensure that their notes or fiat currency could be converted into gold, as was required by their charters.

When central bank reserves declined because of a balance of payments deficit or adverse domestic circumstances, they would raise their discount rates, which are the interest rates at which they would lend money to other banks. In general, this would increase interest rates more, which in turn attracted foreign investment and thereby brought more gold into the country.

Central banks adhered to the gold standard’s rule of maintaining gold convertibility. The amount of money that central banks could supply was constrained by the value of the gold they held in reserve, which determined the prevailing price level. Since the price level was tied to a known commodity whose long-run value was determined by market forces, expectations about the future price level were also tied to it.

The Beginning of the Modern Central Banking System

Before 1914, central banks didn’t place great weight on the goal of maintaining the domestic economy’s stability. This changed after World War I, when they started to become more concerned about employment, real activity and the price level. The shift reflected a change in the political economy of many countries where suffrage was expanding, labor movements were rising and restrictions on migration were being set.

During the 1920s, the Federal Reserve began focusing on both external stability, which meant keeping an eye on gold reserves since the United States was still on the gold standard, and internal stability, which meant keeping an eye on prices, output and employment. The main problem with this was the gold standard. As long as the gold standard prevailed, external goals would remain the primary focus.

Unfortunately, the Federal Reserve monetary policy led to serious problems in the 1920s and 1930s. When it came to managing the nation’s quantity of money, the Federal Reserve followed a principle called the real bills doctrine. The doctrine argued that the quantity of money needed in the economy would naturally be supplied so long as the Reserve Banks lent funds only when banks presented eligible self-liquidating commercial paper for collateral.

One corollary of the real bills doctrine was that the Federal Reserve should not permit bank lending to finance stock market speculation, which explains why it followed a tight policy in 1928 to offset the Wall Street boom. The policy led to the beginning of the recession in August 1929 and subsequently, the stock market crash that took place on October 29, 1929 (Black Tuesday). In the face of a series of banking panics between 1930 and 1933, the Federal reserve failed to act as a lender of last resort.

As a result, the money supply collapsed. What followed was massive deflation and the Great Depression. The Federal Reserve mistake was that the real bills doctrine led it to interpret the prevailing low short-term nominal interest rates as a sign of monetary ease and they believed no banks needed funds because very few member banks came to the discount window.

After the Great Depression, the Federal Reserve System was reorganized. The Banking Act of 1933 and the Banking Act of 1935 shifted power definitively from the Reserve Banks to the Board of Governors. In addition, the Federal Reserve was made to be subservient to the United States Treasury.

The Federal Reserve regained its independence from the US Treasury in 1951, where it began following a deliberate, countercyclical policy under the directorship of William McChesney Martin. During the 1950s this policy was quite successful in the improvement of several recessions and in maintaining low inflation.

Bretton Woods System

At the time, the United States and the other advanced countries were part of the Bretton Woods System, under which the United States pegged the US dollar to gold at $35 per ounce. Other countries pegged to the US dollar. The link to gold may have carried over some of the credibility of a nominal anchor and helped to keep inflation low.

The picture changed dramatically in the 1960s when the Federal Reserve began following a more activist stabilization policy. In this decade, it shifted its priorities from low inflation toward high employment. Possible reasons include the adoption of Keynesian ideas and the belief in the Phillips curve trade-off between inflation and unemployment.

The consequence of the shift in policy was the buildup of inflationary pressures from the late 1960s until the end of the 1970s. The causes of the Great Inflation 1965-1982 are still being debated but the era is recognized as one of the low points in Federal Reserve history. The restraining influence of the nominal anchor disappeared, and for the next two decades, inflation expectations took off.

On August 15, 1971, the United States unilaterally terminated convertibility of the US dollar to gold, effectively bringing the Bretton Woods System to an end and rendering the US dollar a fiat currency. Shortly thereafter, many fixed currencies, such as the pound sterling, also became free-floating. The Bretton Woods System was completely over by 1973.

Paul Volcker’s Shock Therapy

The inflation ended with Federal Reserve Chairman Paul Volcker’s shock therapy from 1979 to 1982, which involved monetary tightening and the raising of policy interest rates to double digits. The Volcker shock led to a sharp recession, but it was successful in breaking the back of high inflation expectations. In the following decades, inflation declined significantly and has stayed relatively low.

Since the early 1990s, the Federal Reserve has followed a policy of implicit inflation targeting, using the federal funds rate as its policy instrument. In many respects, the policy currently followed mirrors the convertibility principle of the gold standard, in the sense that the public has come to believe in the credibility of the Federal Reserve commitment to low inflation.

A key force in the history of central banking has been central bank independence. The original central banks were private and independent. They depended on the government to maintain their charters but were otherwise free to choose their own tools and policies. Their goals were constrained by gold convertibility.

In the twentieth century, most of these central banks were nationalized and completely lost their independence. Their policies were dictated by the fiscal authorities and while the Federal Reserve regained its independence after 1951, its independence was not absolute. The Federal Reserve must report to the US Congress, which ultimately has the power to change the Federal Reserve Act. Other central banks had to wait until the 1990s to regain their independence.

Financial Stability of Central Banks

An increasingly important role for central banks is financial stability. The evolution of this responsibility has been similar across advanced countries. In the gold standard era, central banks developed as a lender of last resort but financial systems became unstable between World War I and World War II, as widespread banking crises plagued the early 1920s and the 1930s.

The response to banking crises in Europe at the time was generally to bail out the troubled banks with public funds. This approach was later adopted by the United States with the Reconstruction Finance Corporation (RFC) but on a limited scale. After the Great Depression, every country established a financial safety net, comprising deposit insurance and heavy regulation that included interest rate ceilings and firewalls between financial and commercial institutions. As a result, there were no major banking crises from the late 1930s until the mid-1970s anywhere in the advanced world.

This changed dramatically in the 1970s. The Great Inflation undermined interest rate ceilings and inspired financial innovations designed to circumvent the ceilings and other restrictions. These innovations led to deregulation and increased competition. Banking instability reemerged in the United States and abroad, with such examples of large-scale financial disturbances as the failures of Franklin National in 1974, Continental Illinois in 1984 and the savings and loan crisis in the 1980s.

The reaction to these disturbances was to bail out banks considered too big to fail, a reaction which likely increased the possibility of moral hazard. Many of these issues were resolved by the Depository Institutions Deregulation and Monetary Control Act of 1980 and the Basel I Accords, which emphasized the holding of bank capital as a way to encourage prudent behavior.

Another problem that reemerged in modern times is that of asset booms and asset busts. Stock market and housing booms are often associated with the business cycle boom phase and busts often trigger economic downturns. Typical central bank policy is to not defuse booms before they turn to busts for fear of triggering a recession but to react after the bust occurs and to supply ample liquidity to protect the payments and banking systems.

This was the policy followed by United States Federal Reserve Chairman Alan Greenspan after the stock market crash of 1987 (Black Monday). It was also the policy followed later in the financial crises of the 1990s and 2000s. The policies were designed to remove the excess liquidity once the threat of crisis had passed.

Central Bank Challenges for the Future

The key challenges facing central banks in the future will be to balance their three policy goals. The primary goal of the central bank is to provide price stability, which is currently viewed as low inflation over a long-run period. This goal requires credibility to work as people need to believe that the central bank will tighten its policy if inflation becomes a threat and this belief needs to be backed by actions.

The second policy goal is the stability and growth of the real economy. There is considerable evidence that suggests low inflation is associated with better growth and overall macroeconomic performance but big shocks still occur, which will threaten to derail the economy from its growth path. When these situations become a threat, research also suggests that the central bank should temporarily depart from its long-run inflation goal and ease monetary policy to offset recessionary forces.

Additionally, if market agents believe in the long-run credibility of a central bank’s commitment to low inflation, the cut in policy interest rates will not engender high inflation expectations. Once the recession is avoided or has played its course, the central bank needs to raise rates and return to its low-inflation goal.

The third policy goal is financial stability. Research has also shown that it will be improved in an environment of low inflation, although some economists argue that asset price booms are created in such an environment. The course of policy should be to provide whatever liquidity is required to diminish the fears of the money market.